GrindFace TV L.L.C is a Entertainment/Media Company. Where we focus on the everyday person who dedicated on build a better future for themselves. Many youth, entrepreneurs or business owners have brilliant gifts, talent or service but nobody will never notice only because they didn't take the time to build an audience. This is where we come in at, showing these individuals to our audience.

Media Coverage: We have a team of videographers and photographers that can come out to your event and capture the moment.

News: Our followers keep each other connected to the news in their Communities by sending us their original content. Where we can bring awareness to the situations.

Mental Health: We're currently working with a Mental Health company to help in the this fight. We trying our best to bridge the gap between entertainment and Mental Health Awareness.

Outreach: We currently have a few good fellas speaking to the youth about life decisions and how the word decision can cost you your life.

Our Vision: Is to build a place where people can come be creative, network and feel safe.

GrindFace TV came together with Garage Guy from Custom Performance Racing Engines out of Gardena Ca. to bring us the hot sauce competition and things got HOT!!

With three extreme hot sauces (Satan's Blood, Meet you Maker & Mad Dog 357) they had 10 contestants competing for $500. This event brought two cultures together to bring their audience a great event. With great tacos for Chef Elvis and jokes from comedian imStynk. But the host Executive Wig kept the audience entertained the whole time.

Executive Wig “Independence”

DOWNLOAD PICTURES HERE

Entrepreneur Dimitrius Mayo

The CEO of Rise 2 GRIND thought of the idea after discovering his own talents. Dimitrius Mayo believed that going to work day after day and not getting gratification could lead individuals into a state of depression, believing that there was no way out of the rat race. After considering his own talents, he learned…

Meet Rising Recording Artist Prince Joseph SZN

A passionate upcoming artist coming outta Palmdale, California recently dropped a 13 song project titled “Rise Out The Gutter.” His mission statement as an artist is to be an inspiration and example for the younger generations, showing boys how to become better men. An artist who actually cares about making music with a message and…

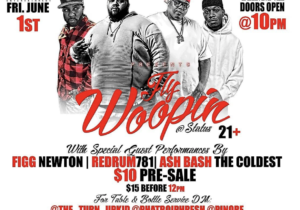

Fly Woopin’

NIT4LYFE ENTERTAINMENT & EXECUTIVE WIG PRESENTS “FLY WOOPIN” DOWNLOAD PICTURES HERE

LowKeyOFTB from The New O.F.T.B Interview

THE NEW O.F.T.B Lowkey & Cool A$$ Beno #WeGoneFlipForever LOWKEY INTERVIEW Original Members Of O.F.T.B – Kevin “Flipside” White – Sammy “Bust Stop” Williams – Ronald “Low M.B.” Watkins Hip-hop group from Watts, California signed to Suge Knight’s DeathRow label w/ various songs on the Above The Rim & Murder was the Case soundtrack. NEW…

When Will Mental Health/Depression Be Taken Seriously?

DEPRESSION ON THE RISE When will mental health, particularly depression, be taken seriously? We talk about the effect it has on people and their loved ones, yet we refuse to be proactive. We have the discussion regarding mental health after the fact when it is too late. Depression is a known issue within the United…

5 Tips for a Healthy and Successful Relationship

By: Dr. Saniyyah Mayo, LMFT 1. Communication – In any relationship there has to be healthy communication. Healthy communication determines how a couple can handle stressful conversations. When engaged in a healthy conversation, no one is talking over the other person or interrupting them. Each person listens intently with the mindset of trying to understand what the…

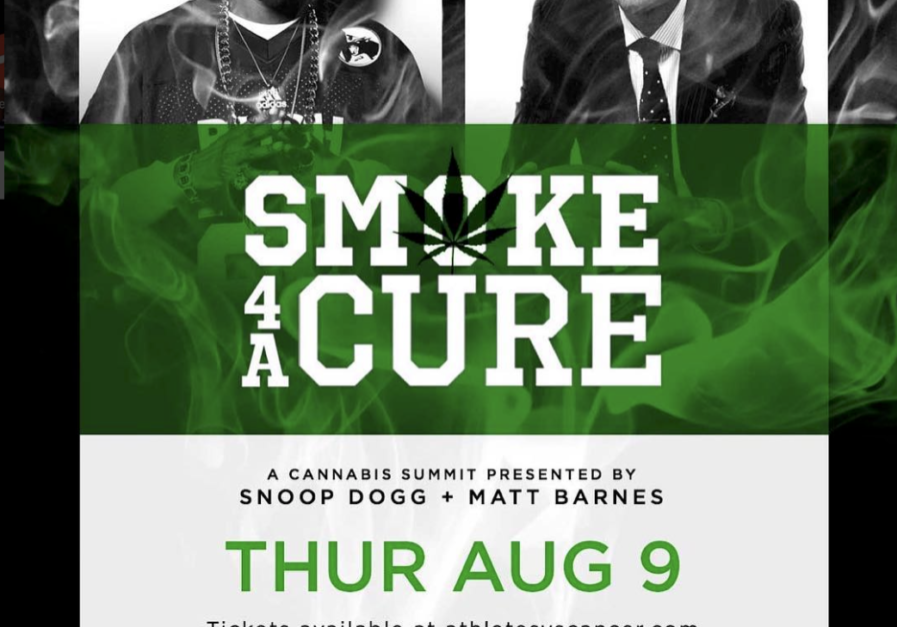

Snoop Dogg | Smoke 4 A Cure | Athletes vs Cancer

Athletes vs. Cancer Founded by NBA Champion Matt Barnes, Athletes vs. Cancer is a 501(c)3 non-profit organization that provides comprehensive resources, support, and advocacy for families and survivors affected by cancer across all populations. In partnership with other athletes, celebrities, and influencers, AVC funds research, education, and outreach to promote early detection with the ultimate…

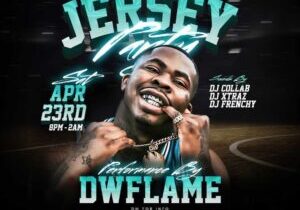

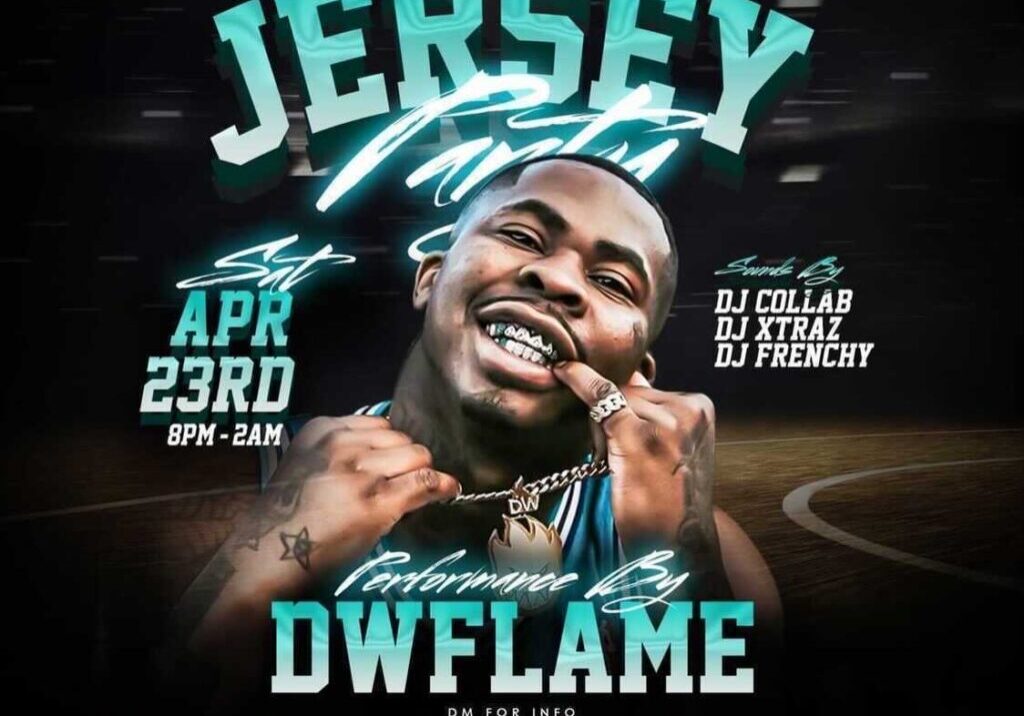

100Summers LA Club Promoter King Bell continues to keep SoCal residents entertained

Club promoter of 100Summers LA, King Bell has been consistently hosting live concerts this year. Some of the show headliners have been musicians like Stunna Girl, BlueBucksClan, and Bino Rideaux. It seems like Bell is set on making an impact and making 100Summers LA a reputable brand when it comes to live shows/parties. The next…

Matt Barnes & Snoop Dogg | Celebrity Flag Football | Athletes vs Cancer

Athletes vs. Cancer Founded by NBA Champion Matt Barnes, Athletes vs. Cancer is a 501(c)3 non-profit organization that provides comprehensive resources, support, and advocacy for families and survivors affected by cancer across all populations. In partnership with other athletes, celebrities, and influencers, AVC funds research, education, and outreach to promote early detection with the ultimate…

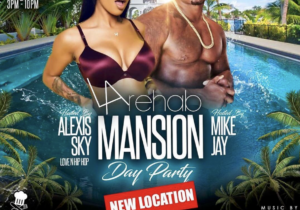

LA Rehab Pool Party

DOWNLOAD PICTURES HERE

Meet Rising Recording Artist Prince Joseph SZN

A passionate upcoming artist coming outta Palmdale, California recently dropped a 13 song project titled “Rise Out The Gutter.” His mission statement as an artist is to be an inspiration and example for the younger generations, showing boys how to become better men. An artist who actually cares about making music with a message and…

GrindFace TV Founder Dimitrius Mayo Lands 5-Figure Marketing Deal With Director Deon Taylor To Promote New Film “Fear”

GrindFaceTV founder Dimitrius Mayo has locked in a five-figure marketing deal with director Deon Taylor to promote the new film “Fear” across his company’s social media platforms Facebook, Instagram and Twitter. The Hidden Empire Film Group production is a horror film that released in theaters January 27. Filmmaker Taylor is best known for directing movies;…

100Summers LA Club Promoter King Bell continues to keep SoCal residents entertained

Club promoter of 100Summers LA, King Bell has been consistently hosting live concerts this year. Some of the show headliners have been musicians like Stunna Girl, BlueBucksClan, and Bino Rideaux. It seems like Bell is set on making an impact and making 100Summers LA a reputable brand when it comes to live shows/parties. The next…

Matt Barnes & Snoop Dogg | Celebrity Flag Football | Athletes vs Cancer

Athletes vs. Cancer Founded by NBA Champion Matt Barnes, Athletes vs. Cancer is a 501(c)3 non-profit organization that provides comprehensive resources, support, and advocacy for families and survivors affected by cancer across all populations. In partnership with other athletes, celebrities, and influencers, AVC funds research, education, and outreach to promote early detection with the ultimate…

Snoop Dogg | Smoke 4 A Cure | Athletes vs Cancer

Athletes vs. Cancer Founded by NBA Champion Matt Barnes, Athletes vs. Cancer is a 501(c)3 non-profit organization that provides comprehensive resources, support, and advocacy for families and survivors affected by cancer across all populations. In partnership with other athletes, celebrities, and influencers, AVC funds research, education, and outreach to promote early detection with the ultimate…

Matt Barnes & Nick Cannon | Pool Party | Athletes vs Cancer

Athletes vs. Cancer Founded by NBA Champion Matt Barnes, Athletes vs. Cancer is a 501(c)3 non-profit organization that provides comprehensive resources, support, and advocacy for families and survivors affected by cancer across all populations. In partnership with other athletes, celebrities, and influencers, AVC funds research, education, and outreach to promote early detection with the ultimate…